Taxes have a profound impact on the dynamics of supply and demand in the market and the behavior of consumers. The imposition of taxes on buyers or sellers does not affect the outcome for both parties, as the total price paid by the buyer and the net amount received by the seller remains the same.

Taxes can shift the supply and demand equilibrium, leading to changes in quantity traded, prices paid by buyers, and prices received by sellers. The incidence of the tax determines whether buyers or sellers bear the majority of the burden. Additionally, taxes lead to a reduction in the quantity traded and a diversion of revenue to the government. This results in a decrease in consumer surplus, producer surplus, and a deadweight loss, which represents lost gains from trade. The size of the deadweight loss is proportional to the square of the tax, indicating that the cost of taxation increases as the tax level rises.

Key Takeaways:

- Taxes have a significant impact on supply and demand dynamics and consumer behavior.

- The imposition of taxes can shift the equilibrium, change prices, and reduce quantity traded.

- The incidence of the tax determines the burden on buyers and sellers.

- Taxes result in a deadweight loss and a diversion of revenue to the government.

- The cost of taxation increases as the tax level rises.

Imposing Taxes on Buyers vs Sellers

When it comes to imposing taxes, whether on buyers or sellers, it doesn’t significantly impact the prices and quantities traded in the market. This is because the buyer considers the total price paid, which includes the price of the product and the tax, while the seller focuses on the net amount received, which is the total payment minus the tax. Hence, regardless of who the tax is imposed on, the outcome remains the same for both parties involved. While the seller typically collects the tax and has the legal responsibility for it, any differences arising from who pays the tax, such as transaction costs, are generally disregarded. However, imposing taxes on buyers can enhance transparency regarding the presence and size of taxes for voters.

Imposing taxes on buyers or sellers has a minimal impact on prices and quantities traded.

Effect of Taxes on Supply and Demand Equilibrium

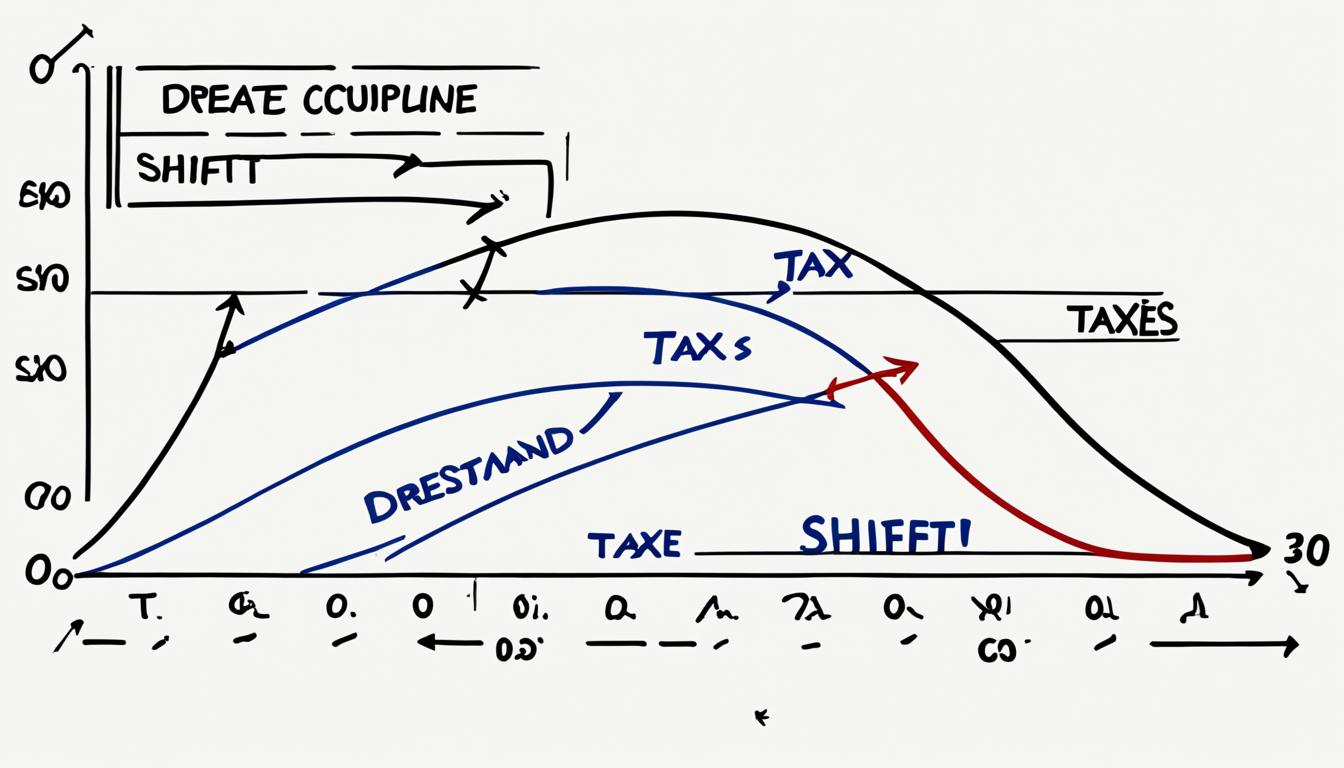

The imposition of taxes on supply and demand has a significant impact on the equilibrium quantity in a market. Depending on whether taxes are imposed on the seller or the buyer, the supply and demand curves undergo specific shifts, resulting in changes in the equilibrium quantity and price.

When taxes are imposed on the seller:

The supply curve shifts up by the amount of the tax. This means that suppliers need to sell their goods at a higher price to cover both the marginal value of the last unit and the tax. The net price received by the seller reflects this adjustment.

On the other hand, when taxes are imposed on the buyer:

The demand curve shifts down by the amount of the tax. This indicates that buyers are willing to pay a reduced price for each unit due to the inclusion of the tax. The price decrease reflects the overall decline in buyer willingness to pay.

Ultimately, the new equilibrium quantity is determined by the difference between the before-tax demand and the before-tax supply, which is equal to the amount of the tax. This equilibrium reflects the balancing point where the quantity demanded by buyers aligns with the quantity supplied by sellers, incorporating the tax into the market dynamics.

This image visually represents the effect of taxes on the supply and demand equilibrium, highlighting the shifts in the curves and their impact on the new equilibrium quantity.

Incidence of Taxes on Buyers and Sellers

Taxes have a significant impact on both buyers and sellers in the market, determining the incidence or burden of the tax on each party. When taxes are imposed, the price paid by buyers increases, but generally by an amount less than the tax itself. On the other hand, the price received by sellers decreases, but also by an amount less than the tax. This implies that the burden of the tax is shared between buyers and sellers. The extent to which each party bears the tax burden depends on the price elasticity of supply and demand.

In some cases, the tax burden may fall more heavily on buyers. For example, if the demand for a product is relatively more elastic compared to the supply, buyers have more alternatives and can choose to reduce their quantity demanded in response to a price increase caused by the tax. As a result, sellers may have limited power to pass on the full burden of the tax to buyers. In contrast, if the supply is relatively more elastic than the demand, sellers have more flexibility to reduce their quantity supplied in response to a decrease in the price received due to the tax. This can result in a higher burden on buyers.

Ultimately, the incidence of the tax depends on the relative elasticity of supply and demand. If one party is more elastic than the other, they will bear a larger share of the tax burden. Understanding the tax incidence is essential for policymakers and market participants to assess the distributional effects and economic implications of taxation.

Economic Effects of Taxes

Taxes have significant economic effects, impacting the quantity traded and the revenue collected by the government. When taxes are imposed, they increase the price paid by buyers and decrease the price received by sellers. As a result, the quantity traded decreases, leading to a reduction in both consumer surplus and producer surplus.

Furthermore, the government collects tax revenue, which is calculated by multiplying the tax amount by the quantity traded. This revenue diversion allows the government to fund various public projects and initiatives. However, taxes also incur a deadweight loss, representing the value of the units that would have been traded without the tax. This lost value is akin to wasting or losing valuable resources.

To illustrate the economic effects of taxes, consider the following example:

“With a tax imposed on a particular good, the price paid by buyers increases by the amount of the tax, while the price received by sellers decreases by the same amount. As a result, the quantity traded decreases, leading to a reduction in consumer and producer surpluses. Additionally, the tax revenue collected by the government is equal to the tax amount multiplied by the quantity traded. However, there is also a deadweight loss associated with the tax, representing the lost gains from potential trades that do not occur due to the tax.”

The economic effects of taxes can be summarized as follows:

| Economic Effects | Description |

|---|---|

| Decrease in Quantity Traded | Taxes increase prices for buyers and decrease prices for sellers, leading to a reduction in the quantity of goods traded. |

| Revenue Diversion | Taxes generate revenue for the government, collected by multiplying the tax amount by the quantity traded. |

| Deadweight Loss | The deadweight loss represents the value of potential trades that are lost due to the tax, resulting in a loss to society. |

The economic effects of taxes highlight the trade-offs and implications of taxation on the market and overall welfare. It is important for policymakers and stakeholders to consider these effects when designing tax policies to ensure a balanced and efficient economic environment.

Small Taxes and Deadweight Loss

Small taxes have an almost zero deadweight loss per dollar of revenue raised. The drop in quantity traded due to small taxes is proportional to the size of the tax. The deadweight loss, which represents the lost value of units that are not economic to trade due to the tax, is proportional to the square of the tax.

Therefore, as the tax level increases, the deadweight loss and the overhead of taxation also increase. Collecting taxes involves costs such as the money raised, the direct costs of collection, and the deadweight loss. The cost of taxation tends to rise as the tax level increases.

Tax Incidence and Elasticity

The incidence of taxes depends on the price elasticity of supply and demand. When considering the tax burden, it is essential to analyze the elasticity of both supply and demand as they determine who ultimately bears the majority of the burden.

In cases where supply is inelastic and demand is elastic, the tax incidence falls on the producer. This occurs because a producer with an inelastic supply cannot easily pass on the tax burden to the consumer. As a result, the producer absorbs a larger portion of the tax.

Conversely, when supply is elastic and demand is inelastic, the tax incidence falls on the consumer. This is because the consumer is less responsive to changes in price, making it difficult for them to avoid the burden of the tax. In such cases, the consumer bears a larger share of the tax burden.

When both supply and demand are either perfectly elastic or inelastic, the tax burden is typically shared between producers and consumers. The specific proportion depends on the relative elasticity of supply and demand.

Illustrative Example:

Let’s consider the market for cigarettes. In this scenario, the demand for cigarettes is relatively inelastic due to addiction and the lack of substitutes. On the other hand, the supply of cigarettes is elastic as producers can easily adjust their production levels.

| Supply Elastic | Supply Inelastic | |

|---|---|---|

| Demand Elastic | The majority of the tax burden falls on consumers as they have more flexibility in reducing their consumption. | The majority of the tax burden falls on producers as they are less able to shift the tax burden to consumers due to the inelastic supply. |

| Demand Inelastic | The majority of the tax burden falls on producers as consumers are less responsive to price changes, making it difficult for them to avoid the tax. | The majority of the tax burden falls on consumers as they have less flexibility in reducing their consumption. |

Key Takeaways:

- Tax incidence depends on the price elasticity of supply and demand.

- When supply is inelastic and demand is elastic, the tax burden falls on the producer.

- When supply is elastic and demand is inelastic, the tax burden falls on the consumer.

- In cases where both supply and demand are either perfectly elastic or inelastic, the tax burden is shared between producers and consumers.

- The degree of elasticity determines the proportion of the tax burden borne by each party.

Increasing Taxes

When taxes are increased, it has a significant impact on the supply curve and the demand curve. Specifically, increasing taxes leads to a shift in the supply curve to the left. As a result, the consumer price increases and the price received by sellers decreases. This change in prices reflects the additional tax burden imposed on the market.

It’s important to note that while tax increases affect the supply curve, the demand curve remains unaffected. This means that the quantity demanded by consumers remains the same, even with the increase in taxes. Additionally, the elasticity of supply and demand is not influenced by tax increases.

The increase in taxes can be considered marginal, meaning it is added on top of existing taxes. The impact of an increase in taxes on a market depends on the size of the tax and the elasticity of the goods being taxed. A larger tax and goods with inelastic demand or supply will result in a more pronounced effect on the market.

Overall, increasing taxes alters the dynamics of the supply curve and the demand curve, leading to changes in consumer prices and prices received by sellers. The specific impact on the market depends on the size of the tax and the elasticity of the goods being taxed.

Effects of Taxes on the Economy

Taxes have a profound impact on the overall economy as they serve as a tool for the government to indirectly influence aggregate demand, which is crucial for maintaining price stability and fostering economic growth.

The imposition of taxes affects individuals’ disposable income, which in turn influences consumer demand. By strategically manipulating taxes, the government can shift aggregate demand, leading to significant changes in output, unemployment rates, and price levels.

The extent of the impact of taxes on the economy is determined by the elasticity of both demand and supply. When demand is more elastic than supply, changes in taxes have a more pronounced effect on consumer behavior and market dynamics.

Understanding the effects of taxes on the economy is essential for policymakers to make informed decisions and create effective fiscal policies. It also helps businesses and consumers anticipate and navigate changes in the economic landscape.

Impact of Taxes on Consumer Demand

The imposition of taxes directly affects individuals’ disposable income, reducing the amount of money available for consumption. As a result, consumer demand may decrease, leading to adjustments in production levels and economic output.

For example, when taxes increase, people have less disposable income to spend on goods and services. This decrease in consumer demand can have a trickle-down effect on businesses, resulting in reduced production, potential layoffs, and a decline in overall economic growth.

Government’s Role in Shaping Aggregate Demand

The government utilizes taxation as a means to influence aggregate demand. By adjusting taxes, policymakers can promote spending or saving, stimulate or cool down the economy, and manage inflation levels.

For instance, during an economic downturn, the government may decrease taxes to encourage spending. This stimulates aggregate demand, leading to increased production and employment, and ultimately supporting economic growth. Conversely, during an inflationary period, the government may implement tax increases to reduce consumer spending and curb price inflation.

Taxes, Price Stability, and Economic Growth

Price stability is vital for a healthy economy, as it fosters consumer and investor confidence. Taxes play a crucial role in maintaining price stability by managing the balance between supply and demand dynamics.

By imposing taxes strategically, the government can address inflationary pressures, reduce excessive demand, and prevent price overheating. This helps maintain stable price levels, sustainable economic growth, and a favorable business environment.

The impact of taxes on the economy is multifaceted, with various factors influencing the outcome. It requires a delicate balance between managing aggregate demand, maintaining price stability, and promoting economic growth.

To delve deeper into the effects of taxes on the economy, let’s examine a table that showcases key indicators and their relationships:

| Indicator | Definition | Impact of Taxes |

|---|---|---|

| Aggregate Demand | The total demand for goods and services in an economy | Taxes influence consumer disposable income and alter spending patterns, thereby affecting aggregate demand levels. |

| Price Stability | A state of relatively stable price levels over time | Taxes can be used to manage inflation, prevent excessive demand, and maintain price stability. |

| Economic Growth | An increase in an economy’s output of goods and services over time | Strategic use of taxes can stimulate or cool down the economy, impacting overall economic growth rates. |

Through careful taxation policies, governments can navigate the complex interplay between taxes, aggregate demand, price stability, and economic growth to foster a prosperous and stable economy.

Effects of Taxes on Savings

Taxes have far-reaching effects on an economy, extending to the realm of savings. An individual’s ability to save is influenced by the amount of disposable income they have, which, in turn, is impacted by taxes. Let’s explore how taxes affect private savings and national savings.

Private Savings

Private savings refer to the savings made by individuals. When taxes are reduced, individuals find themselves with more income available for saving. This increase in disposable income creates an opportunity for individuals to set aside a larger portion of their earnings for future purposes. As a result, reduced taxes often lead to increased private savings, giving individuals more financial security and flexibility.

On the other hand, an increase in taxes has the opposite effect on private savings. When taxes rise, individuals have less income available for saving. This decrease in disposable income leaves individuals with fewer resources to set aside for future needs, leading to reduced private savings.

National Savings

National savings, on the other hand, represent the government’s budget surplus. Taxes play a pivotal role in shaping the revenue available to the government and, consequently, influencing national savings.

When taxes are reduced, the government receives less revenue, resulting in a decrease in national savings. The reduced tax collection contributes to a smaller budget surplus, impacting the government’s ability to save for future investment or use the surplus to reduce public debt.

Conversely, an increase in taxes leads to a rise in national savings. The additional tax revenue collected by the government contributes to a larger budget surplus. This surplus can be allocated towards various initiatives, such as infrastructure development, social welfare programs, or reducing public debt, positively impacting the overall financial stability of the nation.

The effects of taxes on savings highlight the interplay between individual and national financial well-being. As taxes influence disposable income and the government’s budget surplus, they shape the opportunities for individuals and the nation as a whole to save for the future.

Table: Comparative Analysis of Effects of Taxes on Private and National Savings

| Private Savings | National Savings | |

|---|---|---|

| Effect of Reduced Taxes | Increased private savings | Decreased national savings |

| Effect of Increased Taxes | Decreased private savings | Increased national savings |

Conclusion

Taxes play a crucial role in shaping the dynamics of supply and demand in the market and influencing consumer behavior. When taxes are imposed, they can lead to shifts in the supply and demand equilibrium, resulting in changes in prices and quantities traded. Additionally, taxes divert revenue to the government, impacting the overall economy.

The effects of taxes are both short-term and long-term. In the short-term, taxes can reduce the quantity traded and lead to changes in consumer and producer surpluses. Furthermore, the occurrence of deadweight loss represents lost gains from trade. The incidence of taxes, whether buyers or sellers bear the majority of the burden, is determined by the degree of elasticity in supply and demand.

Understanding the effects of taxes on supply and demand is essential for policymakers, businesses, and consumers. It enables informed decision-making in an ever-changing economic landscape. By comprehending the implications of taxes, stakeholders can navigate the market more effectively, maximizing their profits and minimizing the impact of tax burdens.